All Categories

Featured

Table of Contents

A dealt with indexed global life insurance policy (FIUL) plan is a life insurance policy product that supplies you the opportunity, when properly funded, to take part in the growth of the market or an index without directly purchasing the marketplace. At the core, an FIUL is designed to give security for your loved ones on the occasion that you die, yet it can also supply you a wide array of benefits while you're still living.

The main distinctions in between an FIUL and a term life insurance policy policy is the adaptability and the advantages beyond the death advantage. A term policy is life insurance that assures settlement of a stated death benefit throughout a specified amount of time (or term) and a specified costs. When that term expires, you have the choice to either restore it for a new term, terminate or transform it to a costs protection.

Be certain to consult your monetary expert to see what type of life insurance coverage and advantages fit your demands. A benefit that an FIUL uses is tranquility of mind.

You're not subjecting your hard-earned money to a volatile market, creating on your own a tax-deferred asset that has integrated protection. Historically, our firm was a term company and we're dedicated to serving that business yet we have actually adjusted and re-focused to fit the changing requirements of customers and the demands of the sector.

It's a market we've been devoted to. We have actually devoted resources to creating some of our FIULs, and we have a concentrated effort on being able to supply solid options to consumers. FIULs are the fastest growing segment of the life insurance market. It's a room that's expanding, and we're going to maintain at it.

Plan fundings and withdrawals might create an adverse tax obligation result in the event of lapse or policy surrender, and will certainly decrease both the surrender value and fatality benefit. Customers should consult their tax consultant when considering taking a policy finance.

Problems With Universal Life Insurance

Minnesota Life Insurance Policy Firm and Securian Life Insurance policy Company are subsidiaries of Securian Financial Group, Inc.

Universal Indexed Life Insurance

1The policy will terminate if end any time any kind of cash surrender cash money is worth to not enough the monthly deductionsMonth-to-month 2Accessing the cash money worth will certainly lower the offered money abandonment worth and the death advantage.

In 2023, I co-wrote a short article on underperformance of indexed global life (IUL) obstructs. Among the possible drivers of that underperformance was insurance holder habits. Throughout the training course of time, actuaries have discovered several difficult lessons about misestimating policyholder behavior and the efficiency of policyholders. In this write-up, I increase on the possible areas of policyholder behavior risk in IUL items and where actuaries must pay certain attention to the lessons of the past.

:max_bytes(150000):strip_icc()/pros-cons-indexed-universal-life-insurance.asp_v1-e119226901bc464593a496c003551ea0.png)

This short article explores extra behavior dangers to be aware of and appeals the threats gone over in the prior post in addition to supplies some tips on just how to check, recognize and possibly lower these threats. IUL is still a relatively brand-new product, and long-term habits experience is limited.

Those attributes, in specific if the spread goes negative, can drive the product to be lapse-supported. The circumstance gets exacerbated if a business also has reverse choose and ultimate cost of insurance policy prices or anticipates to inevitably have unfavorable mortality margins. Insurance market historical experience has actually shown that lapse-supported products usually end up with ultimate abandonment rates of 1% or reduced.

Via conversations with our clients and using our market surveys, we are aware that numerous companies do not model dynamic surrenders for IUL products the thought being that IUL products won't be delicate to rate of interest motions. Companies must absolutely ask themselves whether or not IUL will certainly be delicate to rates of interest motions.

This can look eye-catching for the policyholder when borrowing prices are reduced and the IUL illustration is showing 6% to 7% long-lasting attributing prices. What occurs when those borrowing prices enhance considerably and the utilize benefit starts to reduce or goes away? With the recent increase in rates, specifically at the brief end of the contour that drives borrowing rates, insurance holders might make a decision to surrender their contracts.

Cost Insurance Life Universal

This presents added habits danger as different car loan or withdrawal behavior can drive various spread profits. Agreements with low finance prices might likewise experience disintermediation if alternative financial investments end up being much more eye-catching about their IUL policy, specifically if caps have actually been lowered and efficiency is lagging assumptions. Poor performance and the failure to funding or withdraw amounts that were previously shown can also bring about an increase in surrender task.

Comparable to how companies research mortality and lapse/surrender, business should on a regular basis monitor their lending and withdrawal behavior about presumptions and update those presumptions as required. Poor efficiency and the lack of ability to car loan or withdraw quantities that were previously highlighted can likewise bring about an increase in abandonment task. Lots of IUL business assume some level of decrements in setting their hedge targets, as many IUL contracts just pay the assured attributing rate up till the end of the index year.

Universal Life Comparison

So, if you're making use of a simplified total decrement price in bush targets, you might certainly introduce hedge inefficacy, particularly if the thought overall decrement price comes to be stale as a result of absence of regular upgrading. The use of a solitary decrement price can additionally lead to hedge inefficacy across problem year mates, as even more recent IUL sales would generally have a higher actual decrement rate than previously issued vintages.

The impact of a gap (discontinuation with no worth) versus an abandonment (discontinuation with worth) can trigger a meaningful difference in earnings. Historically lots of companies priced and modeled their UL items with a consolidated non-death termination price and an overall costs persistency assumption - variable universal life calculator. Where there is positive money surrender worth designed, those complete non-death discontinuations will certainly lead to an expected revenue resource from accumulated surrender fees

Those distinctions will drive variations in habits about UL. As actuaries, we should gain from the past and try to prevent making the same misestimations that were made on several UL items. With that said historical knowledge, and the considerably improved computer power and modeling tools that are readily available today, you should be able to much better comprehend IUL behavior risks.

Term life and global life are substantially different items. Universal life has a variable premium and death advantage quantity, whereas term is repaired; global life is an irreversible life insurance policy product that collects money value, whereas term life only lasts for a certain time period and only includes a death advantage.

Pros And Cons Of Iul

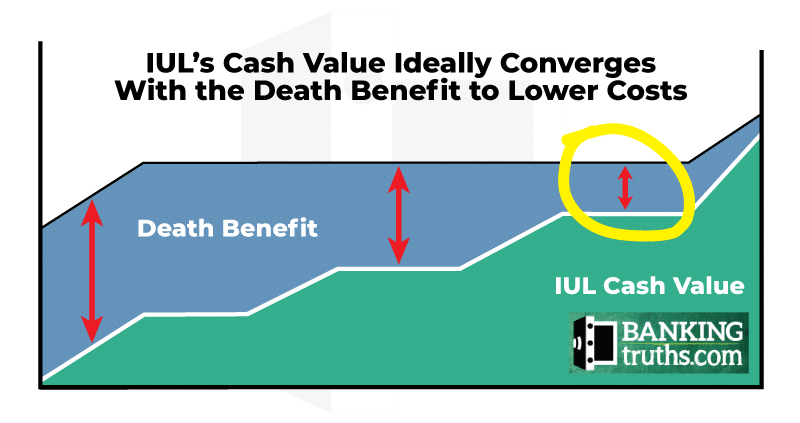

You can underpay or miss costs, plus you might be able to adjust your survivor benefit. What makes IUL various is the way the money value is spent. When you take out an indexed global life insurance policy plan, the insurance company offers numerous choices to choose a minimum of one index to use for all or part of the cash worth account section of your policy and your fatality benefit.

Flexible costs, and a fatality benefit that may also be adaptable. Cash money value, in addition to possible development of that value via an equity index account. A choice to assign component of the money worth to a fixed passion option. Minimum rates of interest assurances ("floorings"), yet there may likewise be a cap on gains, normally around 8%-12%. Accumulated cash value can be made use of to lower or potentially cover costs without subtracting from your survivor benefit.

Best Indexed Universal Life Insurance Companies

Insurance policy holders can choose the percentage designated to the repaired and indexed accounts. The value of the picked index is taped at the start of the month and contrasted with the value at the end of the month. If the index boosts during the month, rate of interest is included in the cash worth.

Latest Posts

Universal Life Insurance With Living Benefits

Insurance Stock Index

Iul Insurance Companies